This information is for you. If you are covered under the following provisions

Shop & office Employees Act

- “Shop” means any premises in which any retail or wholesale business is carried on, and includes a residential hotel and any place where the business of the sale of articles of food or drink or the business of a barber or hairdresser or any other prescribed trade or business is carried on;

- “Office” means any establishment maintained for the purpose of the transaction of the business of any bank, broker, insurance company, shipping company, joint stock or other company, estate agent, advertising agent, commission agent or forwarding or indenting agent, or for the purposes of the practice of the profession of any accountant, and includes-

(a) The offer or clerical department of any shop, factory, estate, mine, hotel, club or other place of entertainment, or of any other industrial, business or commercial undertaking (including the business of transporting person or goods for fee or reward and any undertaking for the publication of newspapers, books, or other literature), and

(b) Such other institutions or establishments as may be declared by regulation to be officers for the purposes of the Act, whether or not they are maintained for the purposes of any profession, trade or business or for the purpose of profit;

- “Remuneration” means salary or wages and includes –

(a) any special allowance determined according to the cost of living

(b) any allowance for overtime work, and

(c) such other allowance as has been prescribed

(a) the exhibition to a customer of any goods kept for sale at such shop,

(b) the answering of question or furnishing of information or explanations relating to the price, description or quality of any goods (whether or not such goods are kept for sale at such shop) or to any matter incidental to the matters aforesaid.

(c) The acceptance of payment in cash or otherwise for goods sold, whether or not delivery thereof has been or is being made,

(d) The taking of measurements for the purposes of compliance with order placed by a customer,

(e) The trial or fitting-on of any article of clothing,

(f) The acceptance by telephone of any order for goods, and

(g) The delivery at such shop during any time when such shop is required to be kept closed by any closing order, of goods purchased while such shop in kept open;

- “Full remuneration” in relation to any holiday or leave granted to a person employed in or about the business of a shop or office, means, in the case of any such person whose remuneration is paid at a monthly rate, remuneration at a rate equivalent to the rate at which such person was entitled to be remunerated for a normal period of employment on the day immediately before the holiday or leave, as the case may be, and in the case of any such person whose remuneration is paid otherwise that at a monthly rate, remuneration at a rate determined in the prescribed manner;

- “Overtime” means overtime in relation to any employment or work, means employment or work in excess of the normal maximum period provided by or under section 3;

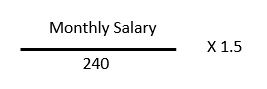

- Manner of OT computation

- Other eligible allowances

According to the No. 36 of 2005 Budgetary Relief Allowances Act and No. 04 of 2016 Budgetary Relief Allowance Act. Private sector employees are entitled to an allowance 3,500/= as budgetary relief allowance:

- Leave

According to the No. 19 of 1954 Shop & Office Employees Act, employees are entitled following holydays:

Weekly Holiday

Every person employed in or about the business of any shop or office shall, in respect of each week, be allowed one whole day and one half-holiday. Such holidays shall be so allowed with full remuneration if such person has worked for not less than twenty-eight hours, exclusive of any period of overtime work, during that week:

Annual Holiday

In respect of the first year of employment during which any person has been continuously in employment in or about the business of any shop or office, that person shall be entitled to take and shall take –

-

-

-

-

- when his employment commences on or after the first day of January but before the first day of April, a holiday of fourteen days with full remunerations;

- when his employment commences on or after the first day of April but before the first day of July, a holiday of ten days with full remuneration;

- when his employment commences on or after the first day of July but before the first day of October, a holiday of seven days with full remuneration; and

- when his employment commences on or after the first day of October a holiday of four days with full remuneration, and the employer shall allow such holiday and be liable to pay such remuneration;and the employer shall allow such holiday and be liable to pay such remuneration,

-

-

-

In respect of the second or any subsequent year of employment during which any person has been continuously in employment in or about the business of any shop or office, that person shall be entitled to take and shall take a holiday of fourteen days with full remuneration, of which not less than seven days shall be consecutive days, and the employer shall allow such holiday and be liable to pay such remuneration.

Casual Leave

In respect of each year of employment during which any person has been continuously in employment in or about the business of any shop or office, that person shall, subject to the provisions of subsection (4) and to such conditions as may be prescribed, be entitled to take on account of private business, ill health or other reasonable cause, leave with full remuneration for a period or an aggregate of periods not exceeding seven days, and the employer shall allow such leave and be liable to pay such remuneration.

-

-

-

-

- The lave to which a person is person is entitled under subsection (3) in respect of the first year of his employment may be taken in that year and shall be computed on the basis of one day for each completed period of two month’s service

- The leave to which a person is entitled under subsection (3) in respect of the second or any subsequent year of his employment may be taken in such year of employment.

-

-

-

Poya day

Every person employed in or about the business of a shop or office shall be granted a holiday on a Full Moon Poya Day:

Provided, however, that in a case where a Full Moon Poya Day falls on a holiday allowed under section 7 of this Act or on a weekly holiday or on a weekly half holiday, no additional holiday shall be allowed to the employee in lieu of that Full Moon Poya Day.

Public Holiday

Every person employed in or about the business of a shop or office shall be allowed a holiday with full remuneration on each of such days, being public holidays within the meaning of the Holidays Act, as are declared be the Minister, by Order published in the Gazette, to be holidays for the purposes of this section, so however, that number of days so declared shall not exceed nine.

Wages Board Ordinance

Trade means – “trade” includes any industry, business, undertaking, occupation, profession or calling carried out, performed exercised by an employer or worker, and any branch of, or any function or process in, any trade, but does not include any industry, business or undertaking which is carried on mainly for the purpose of giving an industrial training to juvenile offenders or orphans or to persons who are destitute, dumb, deaf, or blind;

“Worker” means any person employed to perform any work in any trade

Wage means “wages” includes any remuneration due in respect of overtime work or of any holiday;

“Overtime” means time in excess of the number of hours constituting a normal working day or normal working week;

“Wage period” means the period in respect of which wages are payable under this Ordinance to any worker;

Wages boards minimum wages – See the wages board minimum wages schedule (Link) Gazette notification

Wages boards OT computation method – See the wages board decision (Link)

Other eligible allowances

-

-

- According to the No. 36 of 2005 Budgetary Relief Allowances Act and No. 04 of 2016 Budgetary Relief Allowance Act. private sector employees are entitled to an allowance 3,500/= as budgetary relief allowance

- Wages board leave – See the wages board decision (Link)

- Wages board Working hours – See the wages board decision (Link)

-